Own a Merchant/Agent Business?

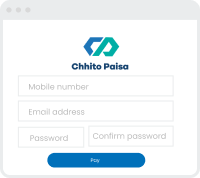

Open an account.

Have a Suggestion/Complain? Click here to reach NRB help Center

Chhito Paisa is committed to providing you with a comprehensive suite of services that cater to your financial needs, ensuring convenience, security, and seamless transactions in the digital age.

Ready to load your wallet, start now!

Start Transferring with Confidence!

Start using Send/Request Fund!

Empower your payment transaction effortlessly!

Chhito Paisa is simple and easy digital wallet to use in

today’s date that makes payment system easy.

Downlaod with just one click.

Register with just an mobile number and password.

Load funds from more than 30 + Banks and Financial Institutions.

Pay your merchant using Chhito Paisa App.

Chhito Paisa is a licensed payment service provider that offers a range of convenient and secure financial services, including mobile payments, money transfers, bill payments, and more.

Registration within the Chhito Paisa Wallet is free. An individual must own the nationality certificates such as citizenship/license/passport/ to register in Chhito Paisa Wallet.

To create a Chhito Paisa wallet, simply download the Chhito Paisa Application from the App Store or Google Play Store. Follow the registration steps, provide the required information, and verify your identity as prompted.

Once you have registered and fulfilled the KYC, you can instantly load the fund into your wallet through Chhito Paisa Application via Mobile/Internet Banking Option, Send-Request Fund Option (from family or friends), and or Chhito Paisa Agent outlet (within inside valley).

For KYC-verified users, the daily limit is two lakhs (Rs 200,000). However, for non-KYC users, they must comply with KYC process first.

You can withdraw the funds through the Chhito Paisa Application itself. Either you can make the bank withdrawal (transfer) or visit the authorized Chhito Paisa Agent for cash out provision (within the inside valley).

Click on the Profile, Go to Account setting, click on change password, enter the current password, set the new password, and confirm. Your Password gets updated.

Click on the Profile, Go to Account setting, click on Change transaction pin, enter the current password, set the new PIN, and confirm. Your Transaction PIN gets updated.

Click on the profile, click on to fill KYC, fill up the information as required, and add the relevant document and photo of yours (Image size must be less than 2MB and with finest quality). Now you can enjoy all the services of Chhito Paisa.

If you face any issues, please contact our dedicated customer support team at the provided contact info on our website or Chhito Paisa Application. We're here to assist you!

Sending money is easy! Log in to your Chhito Paisa wallet, select the “Send/Request Fund” option, enter the recipient’s details, and follow the prompts to complete the transfer.

No. You can load funds via our agent outlet or from the Chhito Paisa counter. However, it is recommended to have a bank account with an I/M banking subscription for easy, fast, and secure transaction processing.

Yes, you can pay various bills such as; utilities, internet, and TV subscriptions, and many more using Chhito Paisa. Select the "Bill Payments" option, enter the required details, and make hassle-free payments.

No, people residing outside Nepal cannot sign up for the Chhito Paisa wallet as they need to sign up using a cell phone number registered in Nepal.

Absolutely! Chhito Paisa wallets are safe to use. We employ advanced encryption and tokenization to protect your data. Additionally, biometric authentication (fingerprint recognition) for added security.

Severely no! In fact, it’s essential to follow best practices, like setting strong passwords and transaction PINs, and one should keep it confidential and secure those credentials from third persons.

An OTP (One-Time Password) is a secure, time-sensitive code used to verify your identity during the authentication process and to authorize transactions. It is typically sent to your registered email address or mobile number.

If your smartphone’s sim (ID) mapped with your Chhito Paisa wallet is lost or stolen, contact at our customer support immediately to suspend or deactivate your wallet. Even if you have changed your number do connect to our support team for further authentication. And, if possible always keep a backup of your wallet information in a secure location.

Since Chhito Paisa is governed and regulated by Nepal Rastra Bank and follows the laws and regulations outlined by regulatory bodies, the amount collected and held within the wallet shall be in the settlement bank (A Class bank) duly appointed by Chhito Paisa and the settlement bank takes all the responsibilities and jurisdiction of wallet balance.